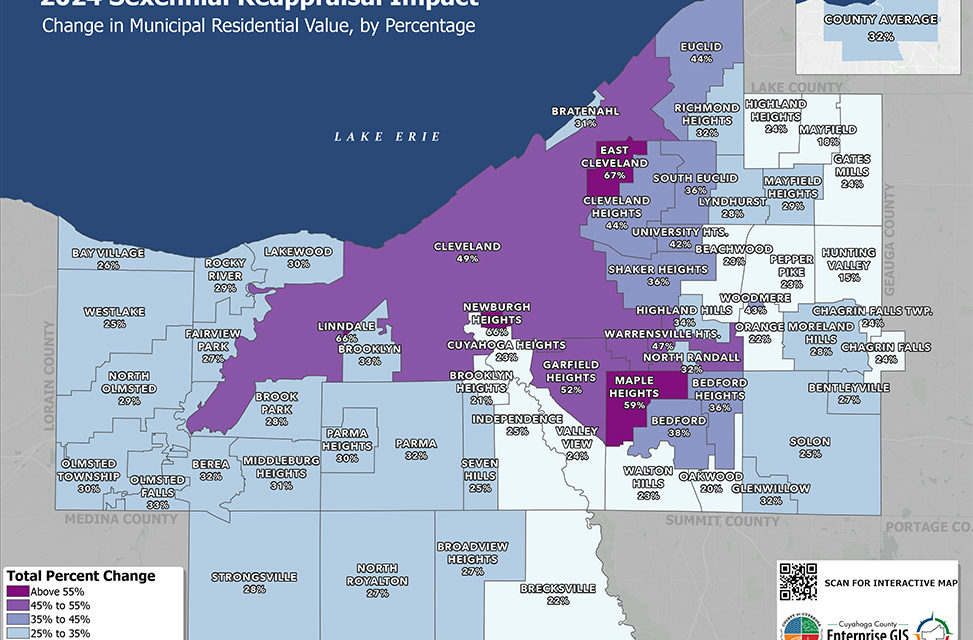

As reported by Kaitlin Durbin with Cleveland.com News, Bedford residents should have received new property values following the recent sexennial reappraisal, which might lead to increased tax bills. Assessments have shown property values increasing across the county, with an average spike of 32% for residential properties. However, tax bills may not rise as sharply due to the 1976 HB 920 law, which adjusts effective millage rates to prevent significant tax increases.

For example, if a Bedford home valued at $100,000 sees a 28% increase to $128,000, the tax bill would rise by only 0.36%. Conversely, a home revalued from $180,000 to $260,000 could see a 13% tax increase. Residents can use the county’s online calculator to estimate their new tax bills based on these assessments.

Homeowners receiving their new valuations are encouraged to review them and can contest the figures if they believe they are inaccurate. Supporting evidence such as photographs or certified estimates must be submitted by August 30 for an informal review. Notifications of any adjustments will be sent out in November, with tax bills arriving in December.

While higher property values might lead to higher tax bills, they also reflect positively on the community’s growth and development. Increased property values can enable Bedford to enhance local services, infrastructure, schools, and amenities, contributing to an improved quality of life for all residents.

To assist residents, the county is hosting information sessions at various locations, including Tri-C East Campus Theatre and Urban Community School, from July 29 to August 1. Additionally, the county will launch a Local Taxpayer Assistance Program this fall, offering financial counseling and potential cash assistance to qualifying homeowners, especially seniors and those with delinquent payments.

For more information or to discuss eligibility for tax programs, Bedford residents can contact the county’s fiscal office at 216-443-7420.