Thirty-five of Ohio’s largest employers paid their CEOs more than 200 times what they paid the typical employee in 2018, according to data reported by companies under the Dodd-Frank Act.

The federal law requires publicly traded companies provide the ratio of CEO pay to the median employee – the person whose pay falls in the middle of all employees.

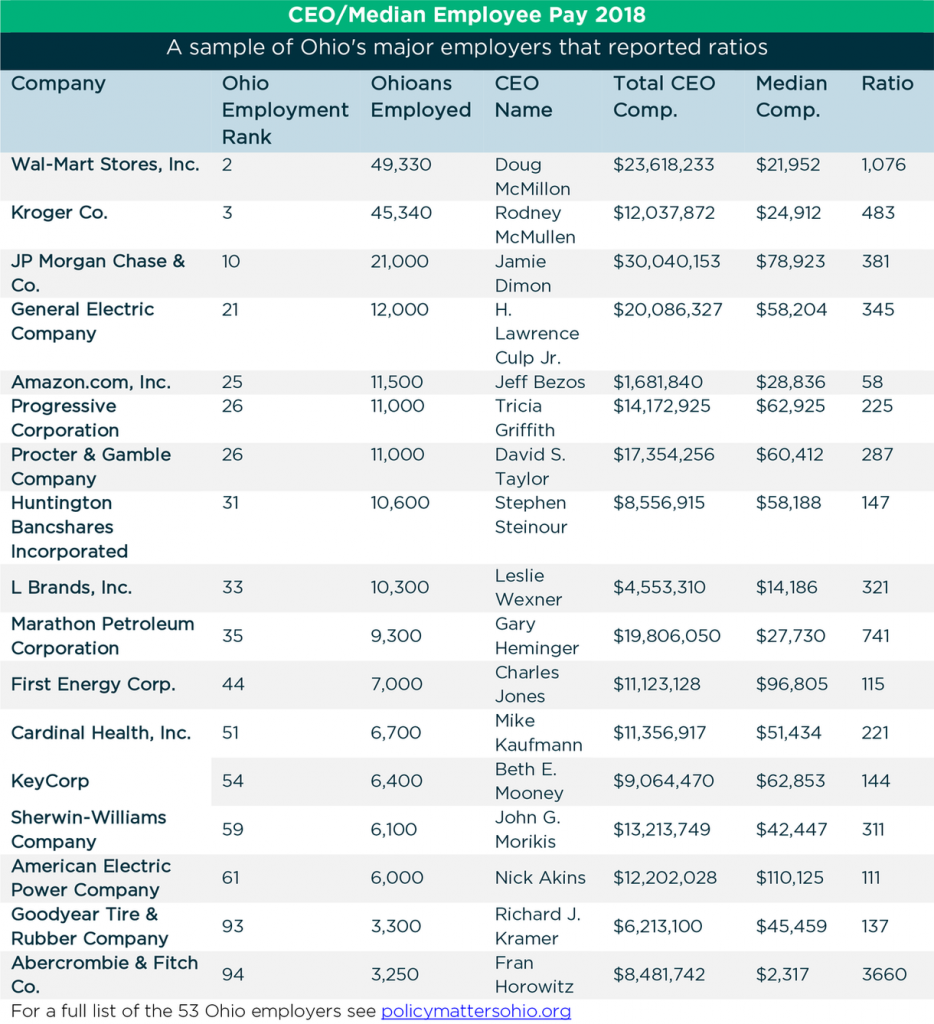

Fifty-three of the top 100 Ohio employers filed reports with the Securities and Exchange Commission (SEC). More than a quarter of those companies paid their CEO more than 500 times as much as they paid a typical employee; six companies paid their CEOs more than 1,000 times as much, according to Policy Matters’ analysis of the reports.

Forty-five of the 53 CEOs at top Ohio employers made more than $5 million, and seven made more than $20 million. CEO Jamie Dimon of JP Morgan Chase made $30 million.

By contrast, in 1968, the ratio of CEO to worker pay at the largest U.S. companies was 20 to 1.

“While corporations have become generous with CEO compensation, they’re far stingier with rank and file employees, who are more productive than ever,” said Policy Matters Research Director Zach Schiller. “The widening gap between CEO and worker pay helps explain why many people don’t feel the benefits of a strong economy — they’re skewed to the top.”

The nine Ohio companies that paid their CEOs the most in comparison to the typical worker were all retail companies. Many of these companies rely heavily on part-time employees. For example, Abercrombie & Fitch had the highest ratio. CEO Fran Horowitz made nearly $8.5 million — 3,660 times the median employee pay of just $2,317.

According to Abercrombie, its typical employee was a full-time student who worked eight hours a week for seven months, which works out to just under $10 an hour.

Cross-company and industry comparisons need to be made with care, since the SEC gave companies flexibility in how they calculate worker pay. Seventeen companies reported median pay of less than $25,000, which is below the 2019 federal poverty level for a family of four. Together, these 17 companies employ more than 210,000 Ohioans.

Meanwhile, the Institute on Taxation and Economic Policy (ITEP) recently released a report that shows the effective 2018 tax rates paid by 379 profitable Fortune 500 corporations. ITEP found 91 companies paid zero in federal income taxes, including major Ohio enterprises American Electric Power, First Energy and Goodyear. These companies had CEO-worker pay ratios in 2018 of 111, 137 and 115 to 1, respectively.

“Federal policymakers should reverse tax laws that have reinforced the pay disparities, like the recent Trump tax cuts,” Schiller said. “They should instead adopt policies that narrow the gap, like tax rate increases on companies with excessively high CEO to typical worker ratios. Ohio lawmakers could adopt state purchasing policies that would give preference to enterprises with smaller ratios between CEO and worker pay and disqualify those with large ones for economic development subsidies.”

Contact: Zach Schiller

216.361.9801

For full article, click here: https://bit.ly/2ZQoPmo

I don’t disagree with this article. But I do believe this should clearly be labeled OPINION. Is there an opposite side? This is skewed one way, and even though it’s my way, I think it brings into question just what this newspaper is trying to be.

Janet, I can see where you are coming from on this. Since the writer is quoting himself, it does make the whole piece seem like it is slanted toward his point of view. It would probably be better either labeled as a viewpoint story, or remove his quotes altogether and just keep the data.